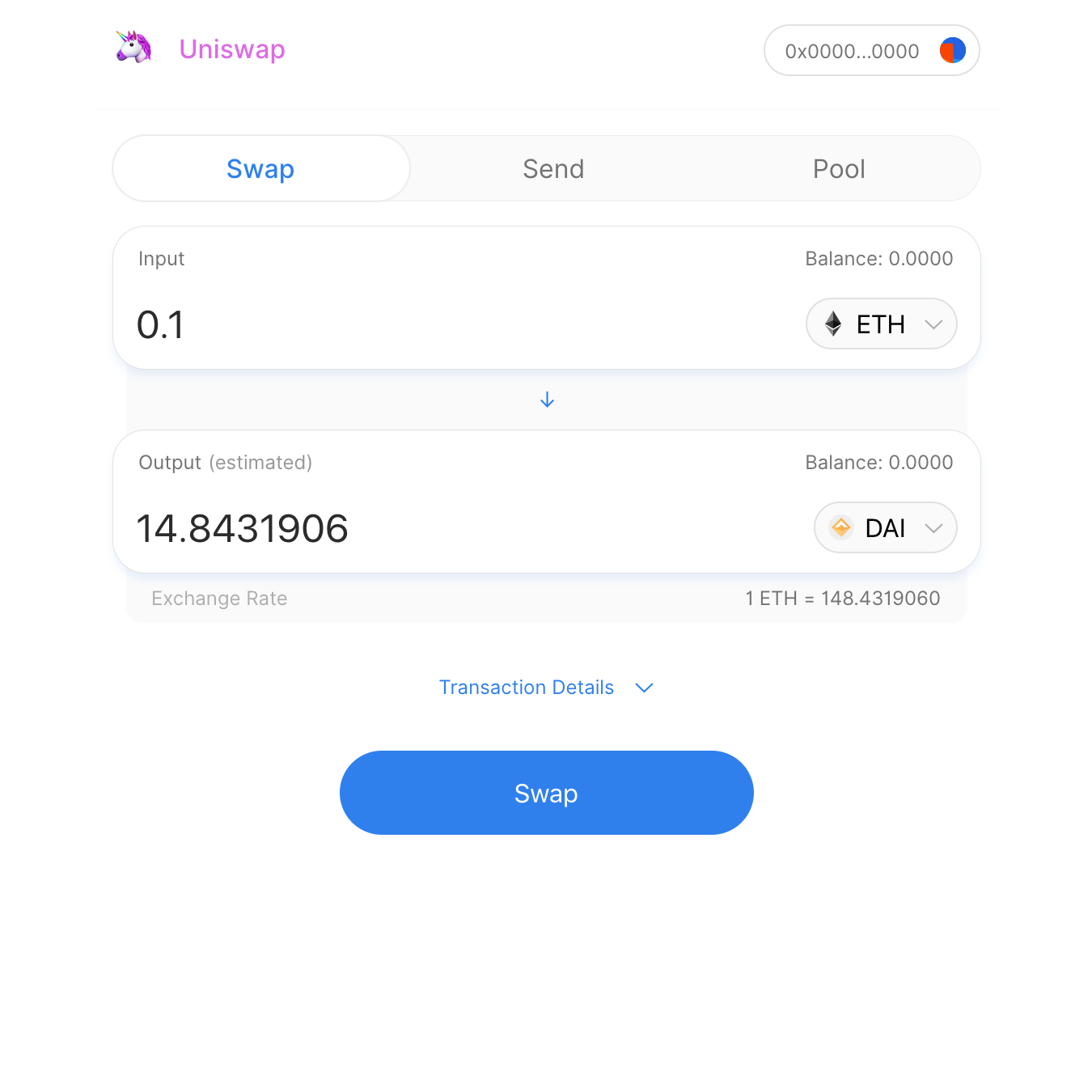

These two decentralized exchanges focus on a simple user experience:

Pick a token you have. Pick a token you want. Swap.

Compare the two side by side and you may not see a big difference. But consider how each project was funded. Uniswap, by a $100,000 grant from the Ethereum Foundation. And Bancor, in an ICO that raised $153,000,000.

What is the result?

Trading volume adjustments

Before we look at the result, here is our methodology for adjusting trading volumes for the purposes of this comparison.

Uniswap and Bancor often fulfil orders by making a series of trades on behalf of their users. The mechanisms employed by these platforms make trading volume more complex to measure from on-chain data.

For example, to facilitate a trader's swap from MKR to DAI, each platform carries out two trades:

| Uniswap | Bancor | |

|---|---|---|

| Trade 1 | MKR<>ETH | MKR<>BNT |

| Trade 2 | ETH<>DAI | BNT<>DAI |

| Trade Outcome | MKR<>DAI | MKR<>DAI |

The impact of how trades are counted on each platform over the report's period is as follows:

| Uniswap | Bancor | |

|---|---|---|

| Trading Volume, individual orders | $4,374,670 | $7,572,600 |

| Trading Volume, including intermediary trades | $4,553,488 | $12,756,781 |

| Difference | 1.04x | 1.68x |

This report avoids counting the same volume more than once by treating each order as one trade regardless of how many trades the platform actually made to fulfil that order.

This report includes all trades made on the Ethereum network, including BancorX trades (Ethereum to EOS).

The Result

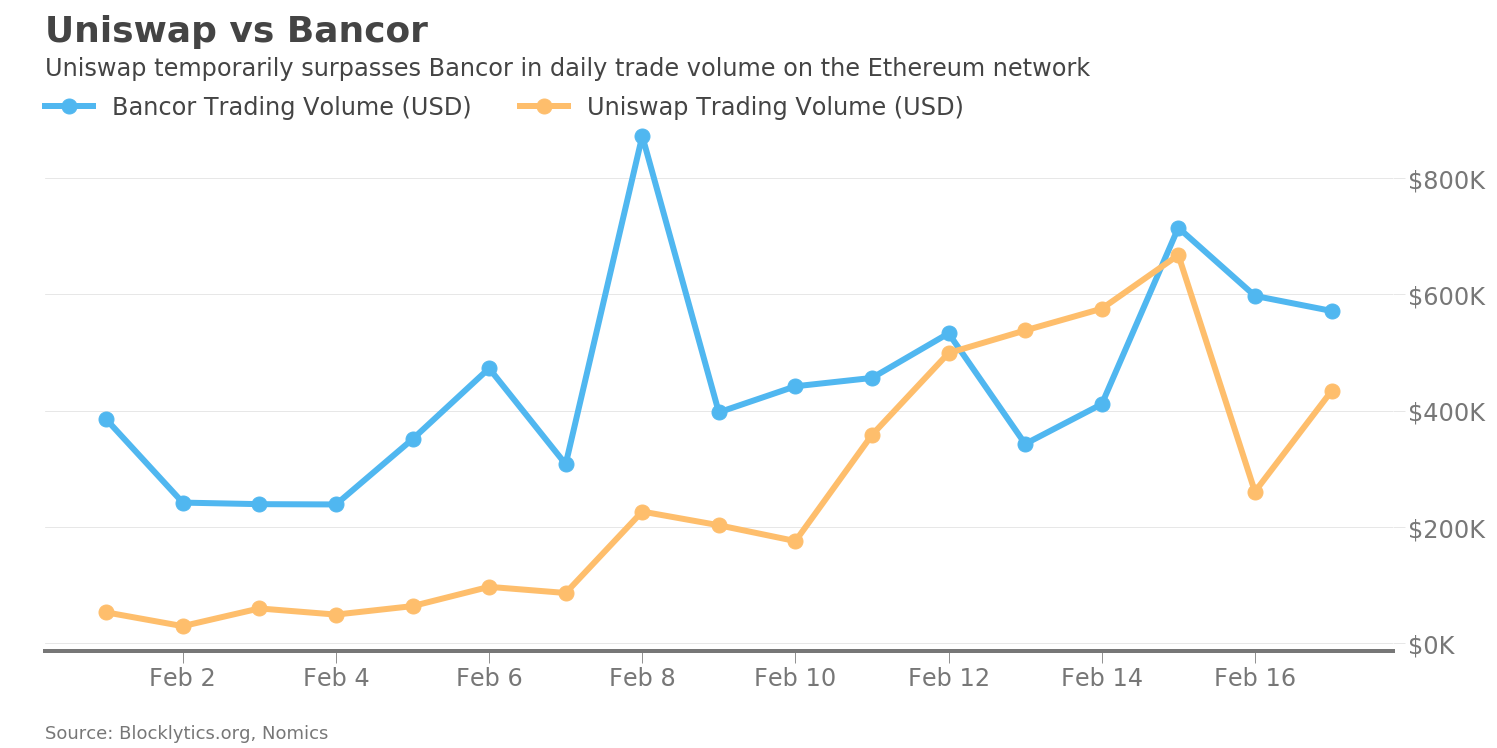

Bancor has enjoyed steady and significant trading volumes on its platform. Uniswap has been growing and received a significant boost to its volumes due to an integration by KyberSwap on February 5, 2019.

Uniswap’s trading volume growth has been explosive, first overtaking Bancor’s volume on February 13, 2019.

In just about every other metric reviewed, Bancor is outperforming Uniswap. Bancor has more active tokens being traded, more trades and more unique Ethereum accounts initiating trades. But for now, Uniswap can say it overtook Bancor in trading volume.