Last month, we started selling ads to support Pools.fyi using custom NFTs on Ethereum. For a quick intro, read: FYI Tokens - NFTs for Digital Ads

Following three successful ad sales (and with a fourth auction in progress), we thought it would be a good time to do a retrospective and share some details about the ads we've sold and the learnings we've applied so far.

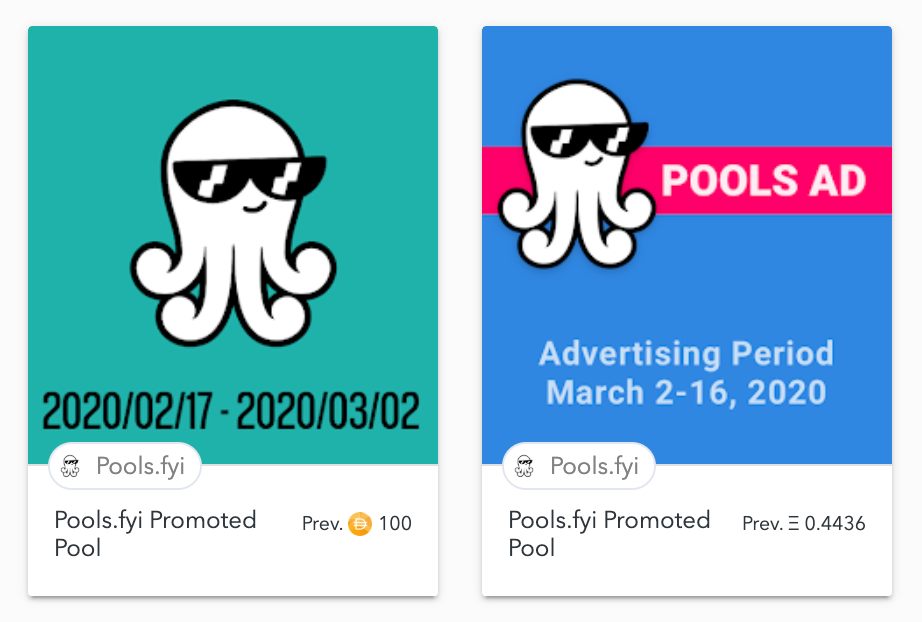

FYI Token Sales - Summary

| # | Price | Advertising Period | Sponsored Pool |

|---|---|---|---|

| 1 | 100 DAI | Feb 17-Mar 2, 2020 | Curve Y |

| 2 | 0.4436 ETH | March 2-16, 2020 | Uniswap ETH-RPL |

| 3 | 0.7868 ETH | March 16-30, 2020 | Uniswap ETH-BCDT |

| 4 | In progress | Mar 30-Apr 13, 2020 | tbd |

First Auction - A Failure?

For our first auction, we decided to try a traditional English auction (think eBay). We began the auction on February 6 with a starting bid of 1 ETH and scheduled the auction to last for 1 week. The first ad received zero bids which we attribute to two factors:

- Price discovery. ETH was skyrocketing during the auction period and the minimum price ended up being higher than the value we received in subsequent sales.

- Auction format. Unlike eBay which lets a user set a max bid that remains hidden from other bidders, OpenSea has public bidding with no such max bid mechanism. Bidders are incentivized to wait until the last second to make a bid to try to get the lowest price possible. Users are likely to forget about the auction in this scenario.

In Andre We Trust

Shortly after the auction ended, we received an offer of 100 DAI. Andre, creator of iearn.finance asked to promote the new Curve Y pool. We graciously accepted and went to work implementing the new Curve platform into Pools.

Then something interesting happened. Andre did not want to redeem his NFT! This was the first sign that introducing a new primitive is also a communications challenge. Redeeming FYI tokens does not require giving up ownership of the NFT.

I couldn't do it. I was suppose to redeem it at https://t.co/mQpil6khaY, but I don't want to. This is token #1. Just look at it. It's pretty.

— Andre Cronje (@AndreCronjeTech) February 21, 2020

I'm going to keep this. I'll try again next week and see if I can convince myself to redeem #2! pic.twitter.com/dYyLWaM3mJ

The Curve Y pool went from 8th position to 2nd position during the advertising period (and subsequently reached 1st position).

Going Dutch

We made a few changes based on our first experience:

- Clarified the NFT design, description and terms

- Changed the auction design to a Dutch Auction, where the price starts at X and decreases to zero until a buyer is found

The new auction format incentivizes buyers to purchase immediately when the price reaches a suitable point - otherwise they risk another potential buyer snatching it before them.

After-Sale Support

The second FYI Token sale went smoothly, with no communication required between us and the FYI Token holder. They purchased the ad and proposed a pool on-chain. We approved the content and the ad started to display.

The third FYI Token sale did result in a support query. We designed FYI token with a manual approval mechanism in order to avoid promoting scams/spam on the site. The user purchased the ad and proposed a pool on-chain while our team was asleep, so it took longer than usual for us to review the proposal and approve the ad. This time lag was confusing because we hadn't clearly communicated that part of the process. We approved the proposed pool the next morning, however, and the ad started to display.

In the future, we will more clearly communicate this part of the process to users. We may also reconsider this propose-approve mechanism to reduce this friction in the redemption process.

The Ad is the Most Effective Ad for the Ad

Our last learning to share is about advertising the ad itself. Our auctions start before the end of the previous advertising period. But, so far, all sales have happened after the previous ad ended and the OpenSea auction is being actively advertised in the empty ad slot. It will be interesting to see if this changes as awareness of the auction cycle becomes more widespread.

Advertise on Pools

Keep an eye out on OpenSea and speak with us on Discord if you're interested .