Uniswap markets are deeply integrated throughout the Ethereum ecosystem and serve as a powerful tool for token distribution. Learn how teams should use Uniswap to maximize token distribution while minimizing losses as an initial liquidity provider.

Key benefits of Uniswap markets

Why bother?

⚡️ Instant, free exchange listing.

⚓️ More easily onboard users who have ether.

🔑 Protect users with a trustless and unstoppable exchange.

🦄 Support and be supported by the Ethereum ecosystem.

📊 Learn from trading activity and product usage.

Great... what's the catch?

An initial balance of tokens and ether is required to support trading. The seed can (and should) be removed later, but is likely to lose value.

Starting new Uniswap markets is an altruistic activity. The academic paper "An analysis of Uniswap markets" highlights this by classifying liquidity providers in two groups:

initial liquidity providers

and

rational liquidity providers

Initial liquidity providers are economically irrational.

Aim for one goal: manage yourselves out

Ideally, teams providing liquidity create a sustainable pool economy and manage themselves out. A high distribution of pool ownership is good for the sustainability of the pool. This requires three steps:

- Seed the pool

- Grow the market to a sustainable level

- Sideline the liquidity

Step 1: Seed the pool

Seeding the pool requires an equal amount of tokens and ether, based on the current market rate. If the token does not have a market rate, then you set this value when creating the pool.

Use only a small portion of your budget to seed the pool in order to minimize any loss due to arbitrage. As trading volumes pick up, the pool will start to make up for those losses. At this point, it makes sense to add more liquidity.

Step 2: Grow the market to a sustainable level

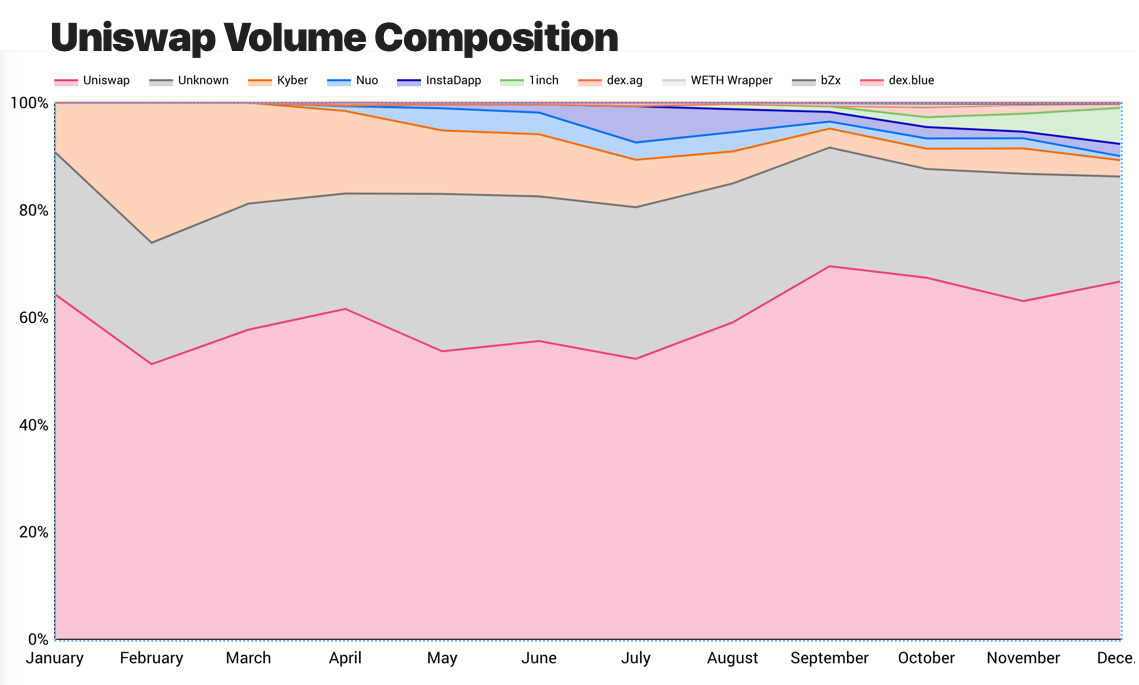

There is a tipping point for pool liquidity. As pools grow, they support bigger trades and attract more traders. More trading volumes incentivize external liquidity providers who grow the pools and attract more traders.

A pool size of ~400X supports trades up to USD X with 0.5% slippage. Based on our analysis of top pools, USD 200k (USD 500 trades with low slippage) is a good target to maximize trading volumes. But, the liquidity target ultimately depends on your users and traders.

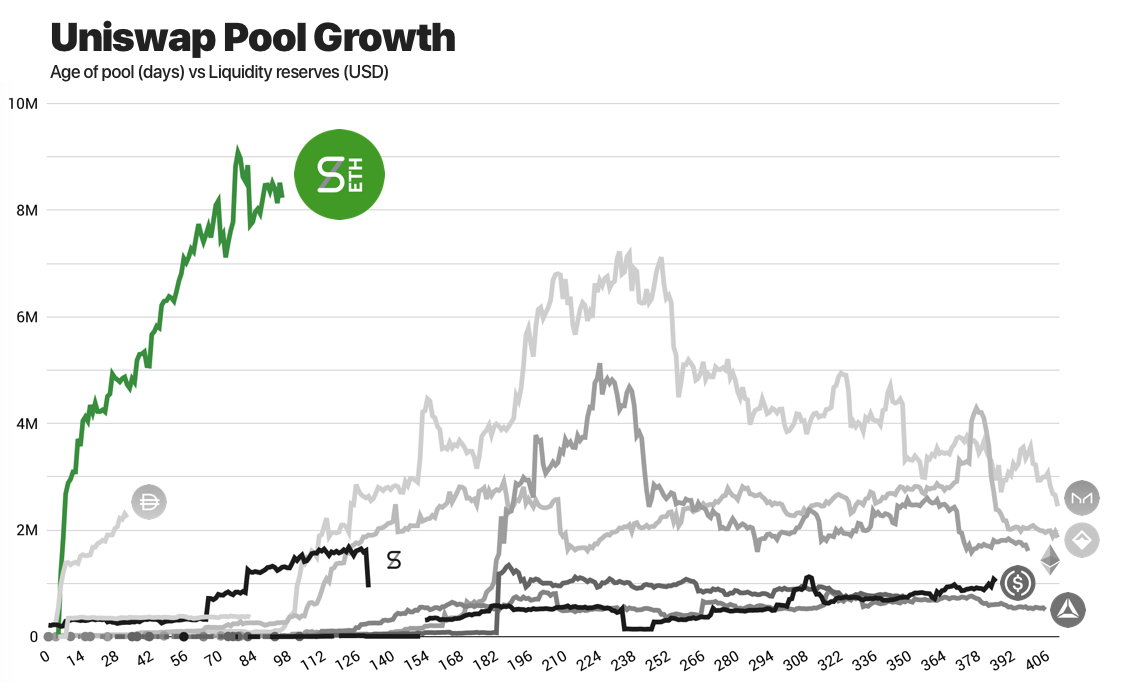

It may be necessary to subsidize external liquidity providers to reach this tipping point. Different options are available – explicit incentives work well as seen in the Synthetix sETH pool.

Step 3: Sideline the liquidity

As external liquidity providers join the pool, seed liquidity should be removed (such that the liquidity target is maintained).

This makes it more profitable for external liquidity providers and attracts additional support. Depending on the market performance, the sidelined liquidity should be saved for the future or put to other uses.

Lessons Learned

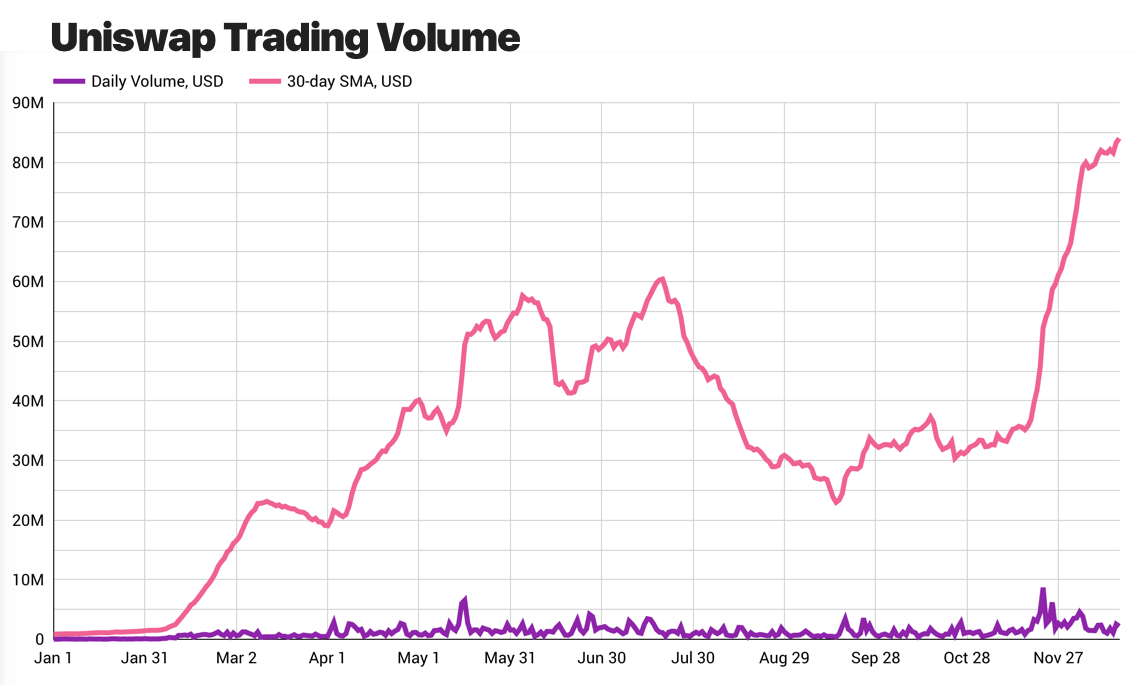

Uniswap has been around since November 2018. Learn from the lessons of teams who have been there:

- Use incentives - the growth of the sETH pool speaks for itself

- Add liquidity over time - massive injections discourage additional providers

- Remove and re-add liquidity during periods of high volatility

Monitoring results

Providing liquidity remains highly experimental. Your team should consider a regular review on:

- Seed balances profit/loss

- Front-running activity

- Arbitrage activity

- Network activity from Uniswap traders

We recommend that each review includes consideration for stopping activity if the Uniswap exchange is not delivering sufficient value to your network.

How can we help?

Send us a note to hello@blocklytics.org if you think our data-driven approach can help you grow your network. You may also enjoy browsing our Uniswap Report archive.