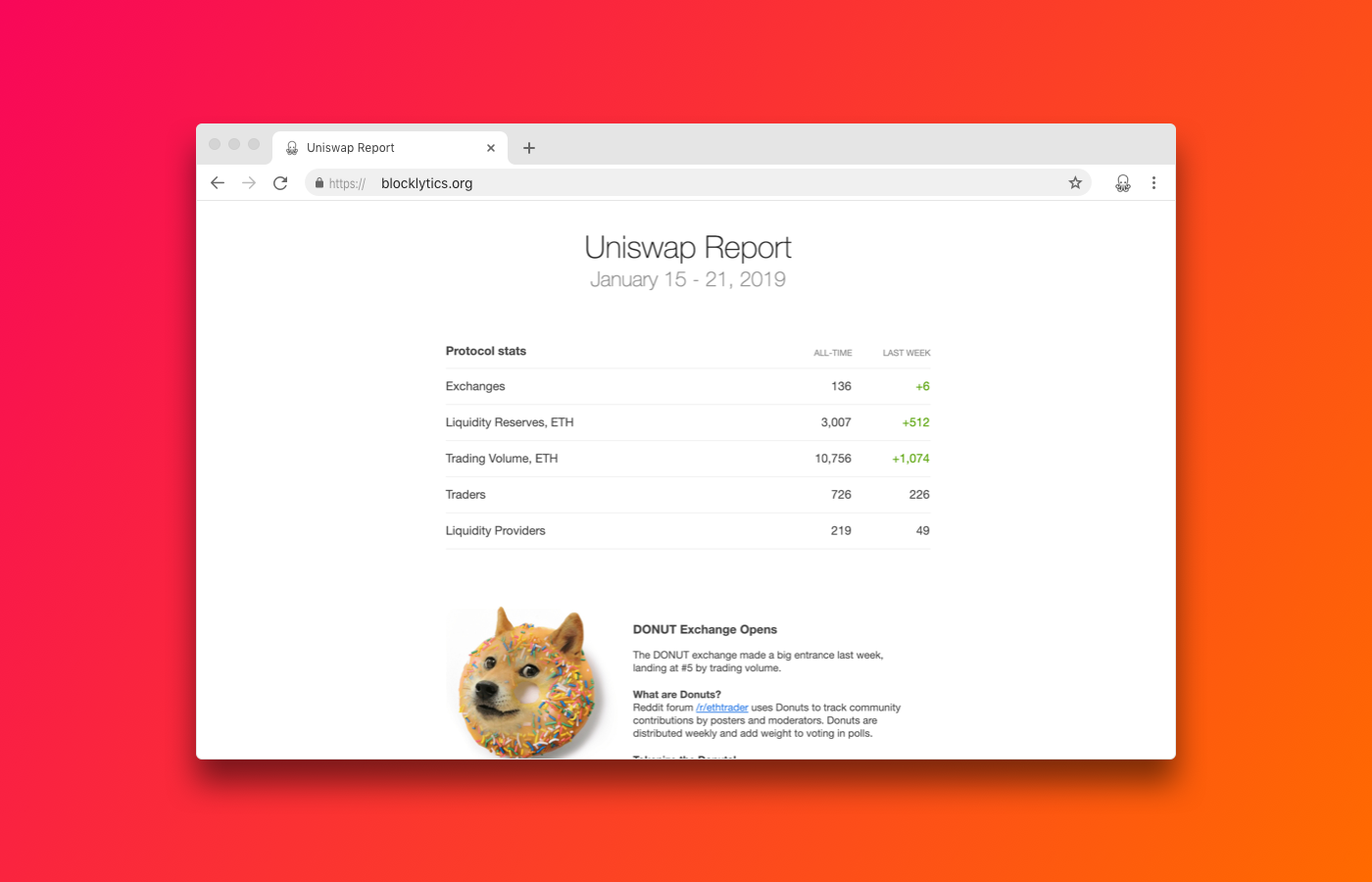

We email a weekly performance report on the Uniswap Protocol. Our email helps analysts, fund managers, developers and community members keep track of one of the most exciting initiatives in Open Finance.

Bonding Curves

Uniswap uses a unique method to settle cryptocurrency trades. Instead of pairing up buyers and sellers, tokens are bought and sold at a rate determined by a bonding curve.

As tokens are purchased, the price goes up. As tokens are sold, the price goes down. In both cases, the exchange rate is determined by a supply curve instead of a market of orders placed by buyers and sellers.

This allows for an extremely slick user experience and makes for a selection of trading pairs that is otherwise difficult to implement on a normal exchange.

The Uniswap Report

For previous editions, see our archive.

If there is a project you think we can help with or you want to get in touch, please email hello@blocklytics.org.